“Dozens of mostly smaller companies from the blockchain sector have relocated to Switzerland in recent months,” wrote Marc Badertscher in the Handelszeitung. And according to his article, “a prominent candidate of a completely different calibre is now in the starting blocks”.

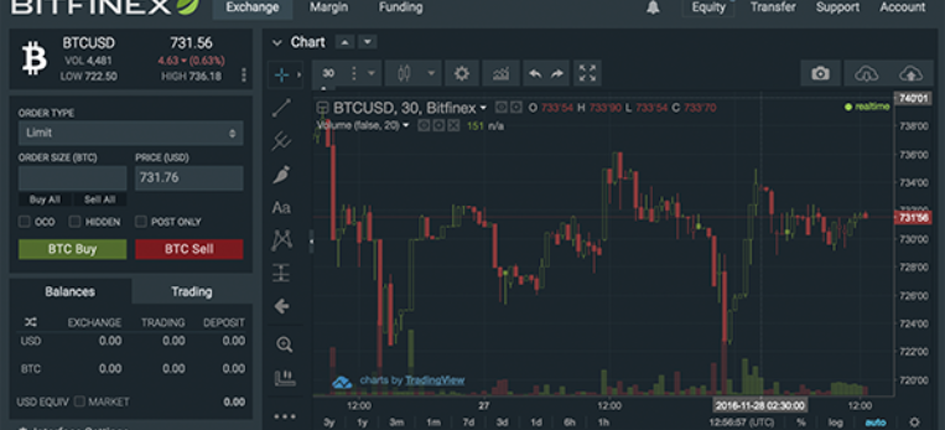

Bitfinex, the world’s leading Asian stock exchange in trade between the dollar and the most important cryptocurrencies bitcoin and ether, is planning a move to Switzerland.

Founded in 2012 in Hong Kong, the cryptocurrency exchange wants to set up business in Switzerland as an AG and replace its previous parent company, iFinex, which is located in the British Virgin Islands. Bitfinex CEO Jean-Luis von der Velde and other managers would also move to Switzerland.

Van der Felde already confirmed the relocation plans to the Handelszeitung, which also reports that several construction meetings have already taken place with the State Secretariat for International Finance (SIF) and Federal Councillor and Minister of Economic Affairs, Johann Scheider-Ammann.

“We want to be the most transparent of all stock exchanges and meet the appropriate requirements of the Swiss regulator,” the Bitfinex CEO said in regards to the move’s motivation. A final decision still depends on the requirements that the Swiss Financial Market Authority (FINMA) will place on the cryptocurrency exchange.

Business development authorities hope that the crypto-giant’s relocation will have a knock-off effect for the entire cryprocurrency sector.

“It would be sensational if an actor of this size and importance should decide in favour of Switzerland,” said entrepreneur and FDP member of the Council of States Ruedi Noser. “It would show that Switzerland can indeed hold a leading position in the entire blockchain sector.”