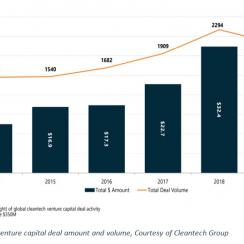

In line with increasing efforts for both the public and private sector, engagement with cleantech innovation is on the rise. From energy corporates such as BP announcing their 2050 decarbonization strategies, to BlackRock’s removing companies which generate revenues from coal production from its actively managed portfolios, the pace of progress speeding up. Globally, Cleantech investments surged above $35 billion in 2019, maintaining a steady 5-year growth trend.

High levels of venture capital investment within cleantech

In the venture capital world, a large volume of investment can be attributed to an increasing interest in both the Agriculture & Food sector, and in increased innovation in the Transportation & Logistics industries. For Agriculture & Food, changing consumer demand is driving global interest in plant-based and lab-grown proteins, as well an consumer food sourcing and online food delivery services. Innovators such as Impossible Foods, Perfect Day Foods, DoorDash, Picnic, Grofers, Wolt and Rebel Foods all have gained momentum in the last 18 months. In Transportation, the automotive sector has reached an inflection point in its decarbonization path, resulting in an increasing interest in electric vehicles, logistics, and mobility services. Players such as Rivan, Convoy, Bird and Bounce are examples of startups who received $100 million + in investment rounds in 2019. In combination, both these industries accounted for 58% of the 2019 investment total (see table 1 below).

Sector Focus: Energy & Power Investment Trends

Despite investment within the Energy & Power sector taking up a relatively small part of the global investment total, investment has been on the rise. 2019 was the highest in the past 6 years with a total of $3.95 billion investment total and 447 total deals over the 12-month period. Globally, Utilities and Energy Players are increasing carbon commitments, resulting in increasing corporate engagement in early stage innovation through venture investment and acquisition. Some examples include:

- Enel announced a $31 billion upgrade to its renewables program, planning to derive 60% of its power generation from renewables by 2022

- National Grid revised its target to now match the UKs net zero by 2050 goal

- Repsol announced aims to achieve net zero emissions by 2050

A key area of innovation is in the battery market, where despite a ten-fold drop in costs over the past decade, Lithium-ion battery costs remain the biggest reason why electric vehicles remain uneconomical. Innovators are aiming to solve these problems via cell-level alterations and are gaining investment from the automotive companies. For example, developer of silicon anode-based lithium-ion solutions Sila Nanotechnologies, raised $215 million in a Series E round from an assortment of companies including Daimler, Bessemer Venture Partners nexy47 and others.

Sector focus: Resources & Environment Investment Trends

Last year, Resources & Environment innovators raised over $2 billion globally across 246 deals. Carbon Capture, Recycling & Waste and Construction innovators including Svante, Vinted and BrightMark Energy raised considerable investment last year. Responding to public and regulatory pressure, consumer facing corporates are increasing efforts to pursue sustainably ventures. Some examples include:

- At the end of 2019, Coca-Cola partnered with Diesel, launching a recycled fashion range. Coca-Cola also partnered with PepsiCo and Keurig Dr Pepper to launch the Every Botte Back Initiative, reducing the use of new plastics and improve recycling.

- Supermarket Co-op committed to 100% recyclable packaging on its own brand products by summer 2020 and have plans for an in-store take-back scheme for non-recyclable plastics.

A key area of innovation for the sector is in the construction market. Construction and buildings remain responsible for 38% of global emissions, producing ~25%-30% of all waste in Europe. 2019 marked the start of a venture investment foray into construction site management software and other construction technologies. In the US, investment into startups rose by over 300% including some large investments including Katerra, which raised $856 million in 2019 led by Softbank. Innovation startups such as Procore and Congruex, both raised $112 million and $75 million respectively. Additionally, construction-based venture funds have started to emerge, including MetaProp and Brick & Motor Ventures.

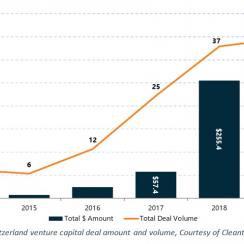

Country Focus - Swiss Investment Trends

Similarly, to the global trends, The Cleantech Group found Cleantech investment into Swiss-based companies is also on the rise. Last year, they tracked a total of $371 million over 39 deals were invested into innovators. This is in line with the broader venture trend in the country. Last year, Swiss startups attracted nearly $2.4 billion from investors, nearly doubling the $1.23 billion collected in 2018. Figure 2 below shows Switzerland venture capital investment over the past 6 years as tracked by The Cleantech Group (see table 2 below).

Decarbonization is a core pillar of venture investment in the country, therefore Energy & Power remains a focus of the country’s investment with a total of 54% of the volume share. Some interesting deals last year included:

- The largest deal over the past 18 months in Switzerland was the $110 million Series B investment into EnergyVault, a developer of an energy storage system using stacked concrete blocks. The company received funding from Softbank and also CEMEX Ventures, as they demonstrated the first 35MWh storage tower in the north of Italy in 2019.

- Wayray, a developer of AR technologies for automotive vehicles raised $80 million in a Growth Equity round from Porsche, Hyundai, and others.

- Climeworks, developer of commercial carbon dioxide removal technology to remove CO2 from the atmosphere, raised $30 million from Zürcher Kantonalbank. The company also recently partnered with carbon utilization innovator, Svante, to develop carbon capture technology under a Joint Development Agreement.

The large volume of activity in Switzerland demonstrates that it remains a great place for startups to flourish, with entrepreneurial activity at 8.0% compared to the EU's, which sits on average at 6.7%. Despite startups in the cleantech sector only accounting for 4.9% of total deals in 2019, the companies that come from the country such as tiko Energy Solutions, Chargedot and Cassentex have managed to have a global reach, all being acquired in the last year.

About the Cleantech Group

The Cleantech Group provides research, consulting and events focused on sustainable growth powered by innovation. As industries are undergoing definitive transitions toward a more digitized, de-carbonized and resource-efficient industrial future, the Cleantech Group focus on the trends, companies and people shaping the future and the customized advice and support businesses need to engage external innovation.

At every stage from initial strategy to final deals, their research identifies the corporate change makers, investors, governments and stakeholders from across the ecosystem.