According to an article published by startupticker.ch, the pharmaceutical firm BioLingus, headquartered in Hergiswil in the canton of Nidwalden, has filed an application for an IPO on the Nasdaq stock exchange in New York, for which 3 million shares are to be offered at a price of between 15 and 16 US dollars. This would generate gross proceeds for BioLingus of between 45 and 49 million US dollars. In financial year 2022, the company posted a net loss of 1.4 million US dollars and zero revenues, the article explains. BioLingus is to be listed as SUBL on the Nasdaq.

Since being founded in 2014, BioLingus has focused on the development of sublingual drug delivery. BioLingus is developing oral versions of products that are currently only available in injectable form, according to the article. The primary focus here is on areas such as diabetes and obesity, with BioLingus estimating that the conversion rate from injectable to oral formulations could be as high as 80 percent overall.

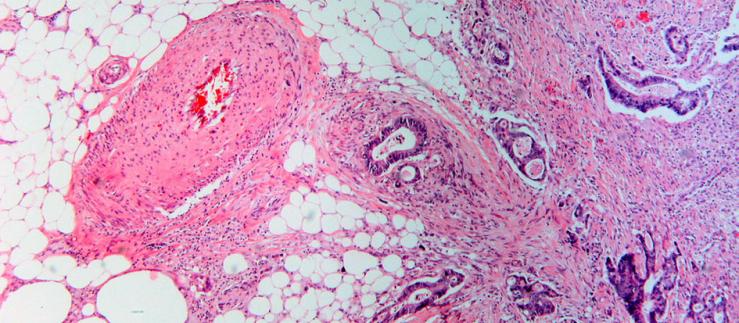

The sublingual area lies under the tongue and is lined by a thin layer of cells rich in blood vessels. Sublingual delivery has been successfully used for a range of small molecule drugs for many years now. BioLingus is now aiming to use the special properties of the sublingual area to also administer peptides and proteins effectively.

The BioLingus product candidate Sublingual Liraglutide to treat obesity is currently being tested in a phase Ib/IIa clinical trial with the aim of determining the optimal dose range in humans. The study, which has been taking place at the Clinical Trials Center of the Chinese University of Hong Kong since the end of April, is expected to last six to nine months.