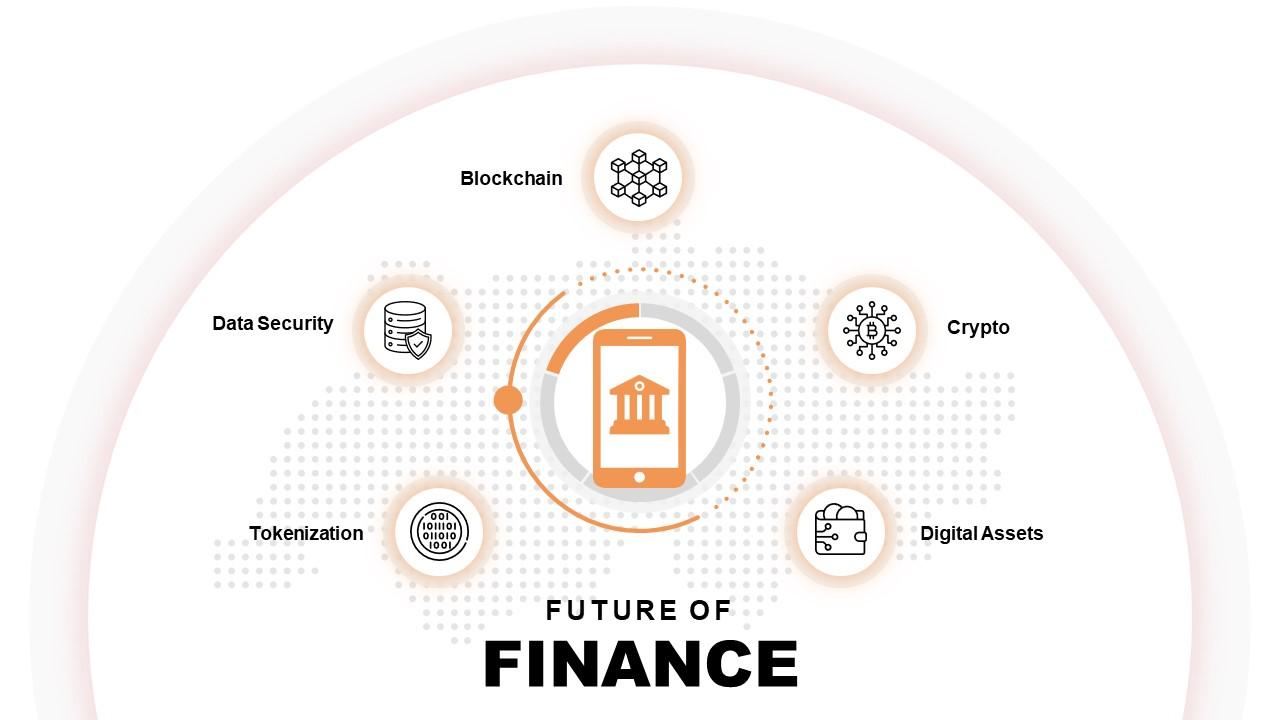

Switzerland is one of the world's leading financial centers, known for its stability and commitment to data security. A tradition in private banking, combined with constant innovations from the fintech and crypto sectors, make Switzerland a location with a future for your finance venture. Get in touch to find out how your finance business can thrive in this dynamic ecosystem.

#WhySwitzerland

#WhySwitzerland

Enjoy a safe and innovative legal framework

Switzerland's technology-neutral stance allows for the selective integration of new technologies into existing legislation. Since 2017, Switzerland has facilitated fintech entry through a sandbox regime by FINMA, the Swiss Financial Market Supervisory Authority.

Collaboration with industry stakeholders led to the 2020 DLT Bill amendment, incorporating crypto assets and digital ledger technology into Swiss Law and making the Swiss blockchain regulatory framework one of the most advanced in the world.

The Federal Data Protection Act mirrors GDPR, obligating financial institutions to implement cybersecurity measures for data integrity and security. This comprehensive approach ensures the integrity and security of your financial data in Switzerland.

Collaborate pragmatically with leading research institutes

A share of approximately 25 percent of global assets is managed on a cross-border basis, which makes Switzerland a global leader in the wealth management business. Switzerland has been a pioneer in adopting tokenization, allowing real-world assets to be represented on the blockchain. This breakthrough has created new possibilities for fractional ownership and increased liquidity.

The financial sector faces challenges in terms of data protection and cybersecurity. Initiatives like Trust Valley address these challenges to make sure Switzerland continues to make significant progress on removing barriers to market entry and set a legal framework that enables your company’s innovations, rather than impedes them.

Develop powerful partnerships to scale your business

Switzerland has a well-established and dynamic finance ecosystem that is globally recognized for its stability, innovation and influential presence. Large Swiss insurance companies and banks play a crucial role in developing solutions for the finance industry.

Because Switzerland has been a pioneer in adapting blockchain technology, your company can now benefit from this collective know-how. Service providers including law firms and the world’s first crypto banks Sygnum and Seba specialize in blockchain and crypto assets and offer legal and regulatory guidance as well as financial services tailored to the unique needs of your company.

Attract and retain the best people for your business

Switzerland's fintech talent pool combines the country's long-standing tradition in banking and wealth management with top skills from tech graduates and seasoned executives. Swiss universities in Basel, Zurich and other cities contribute to this talent ecosystem with blockchain research and offer new training programs like a digital compliance officer course for blockchain.

Switzerland’s bilateral agreements allow companies to recruit top talent from EU countries, since no visas are required for EU citizens. Labor market flexibility, liberal legislation, competitive salaries and an exceptional quality of life further strengthen Switzerland as an attractive destination for professionals in the dynamic fintech sector.

#SwissTech4Good

#SwissTech4Good

Use resources responsibly to meet current needs without jeopardizing those of future generations: this is how start-ups, scale-ups and corporations approach sustainability in Switzerland. We would like to show Switzerland’s impact in sustainability with the following example in this Ecosystem: The food and hospitality company Gabbani has integrated a bitcoin mining system into its production facility, which is powered using the business’s surplus solar power. Its panettone Christmas cake is now labelled Banettone and features a Bitcoin logo.

Ecosystem Switzerland

Ecosystem Switzerland

News

News

Do you want to know more about related fields?